According

to the president of the CCPIA, China’s pesticides industry will prosper again

in 2017, after facing some setback in exports 2016, where both quantity and

value of exports declined. The reasons are the policy of China’s government

regarding planting and crop protection as well as environmental protection and

consumer needs.

Source: Pixabay

Market

intelligence firm CCM has summed up the outlook of Sun Shubao, the president of

the China Crop Protection Industry Association (CCPIA), in terms of the

pesticides industry in China for the year 2017. Sun Shubao predicts a rebound

of China’s pesticides exports, which amount to 50% of all pesticides sales. The

strengthened exports are the main drive for China’s pesticides manufacturers to

experience improvements in 2017.

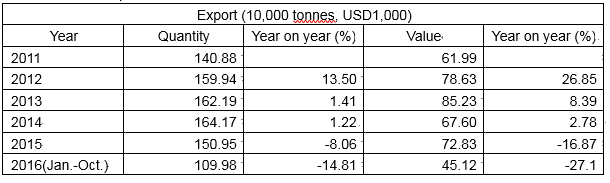

China

Pesticide export data 2011-2016

Source:

CCPIA

Five

main factors will push the pesticides industry in China for the next years and

back up the positive development of it.

Change of planting areas

China’s

government is changing the plans for planting areas of several crops. This

includes providing more area for rice and wheat to meet the domestic demand and

become independent of grains imports. However, the planting area of other crops

will be adjusted to occurring market trends. Since China is importing a huge amount

of cheap gen-manipulated corn, the domestic planting area will be reduced

accordingly and replaced by plants like soybeans. This will keep the demand for

pesticides high.

The

environmental protection efforts are another factor in reconstructing the

pesticides industry in China. Due to stricter inspections and regulations. Outdated

production as well as small and medium-sized companies are likely to withdraw

from the market, leaving a tighten supply and hence increasing prices. This

trend is supported by the same situation for upstream products of pesticides

like glycine.

Reducing crop protection companies

Speaking

of environmental protection, China’s

government is aiming for reducing the total amount of crop protection companies

by 30% to fulfill the goals of environmental protection. Following this plan

are promotions and encourages of mergers and acquisitions for Chinese

manufacturers. According to CCM, no new pesticides company was established in

China in the last two years. The strategy is supposed to enhance production

variety and innovation.

M&As

As

mentioned beforehand, China’s government is supporting M&As to reduce

domestic pollution and strengthen innovation. CCM believes, that this strategy

will help the big manufacturers with enough money for investments to develop in

a healthy and sustainable manner. However, domestic M&As are barely

recognized and do not have the wide-sweeping effect than multinational acquisitions.

In addition, acquisitions of Chinese manufacturers have the benefit to get

their product line into global markets by using the Sales channels of the mother

company and utilize the knowledge and experience for marketing and sales

purposes. Hence, China’s manufacturers will become for competitive in the

global market.

Export tax rebates and safety

According

to Sun Shubao, currently the export rebate for pesticides formulation is

smaller than the one for pesticide technical. This situation should be

reversed, by giving formulation a higher export rebate than technical.

The

incorrect use of pesticides is still a huge problem in China, which mostly

occur on farms, whose farmers are not informed about the correct use of

pesticides. The most common mistakes are overuse of pesticides or some misuse.

Hence, the CCPIA is increasing efforts to educate farmers about the use of

pesticides, by turning small producers into service providers, who can guide

farmers in the best use of pesticides. Also, the efficacy of pesticides in

general should be improved, while setting the focus on bio pesticides.

GM

The

last factor is regarding to gen-manipulated corn in China. China is currently

spending a huge amount of money into the research of GM corn, to lower the dependence

on pesticides usage in general. However, despite from one successful

implemented GM corn in China, most of the GM crops have not successfully

implemented into the market yet. This also collides with the demand of Chinese customers,

who are still very skeptical towards GM crops like soybean.

About CCM

CCM is

the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets.

Do

you want to find out more about the chemicals market in China? Try

our Newsletters and Industrial Reports or join our professional online

platform today and get insights in Reports, Newsletter, and Market Data at

one place.

For

more trade information of fluoride, including Import and Export analysis as

well as Manufacturer to Buyer Tracking, contact our experts in trade

analysis to get your answers today.

Looking

for a convenient way to get comprehensive and actual information as well as a

platform to discuss with peers about the latest chemicals industry

and market trends? Simply subscribe to our YouTube Channel and join

our groups on LinkedIn and Facebook.